am i taxed on stock dividends

For example assume a company holds 5000 common shares. TDs stock is classified as a value stock since it trades at inexpensive valuation multiples.

:max_bytes(150000):strip_icc()/investment-statement-depicting-asset-allocation-172140833-5a905c56a18d9e0037d8949a.jpg)

Mutual Fund Dividend And Capital Gains Double Taxation

12 hours agoUsing their low end 2022 guidance for non-GAAP normalized EPS for 2022 of 156 the 092 annual dividend implies a 59 payout rate.

. Tax rate on dividends over the allowance. Stock Price Dividend and Yield for. Under current law qualified dividends are taxed at a 20 15 or 0 rate depending on your tax bracket.

However they are often confused on how PIK dividends are taxed. Adani Ports Chambal Fertilizers Cholamandalam Dhanuka JK Tyre Kansai Nerolac Karnataka Bank LIC Housing Fiaance Sun Pharma Tata Investment Tech Mahindra. To work out your tax band add your total dividend income to your.

Even though only half of the capital gains are included in taxable income the. The Dividend History page provides a single page to review all of the aggregated Dividend payment information. The tax rules that apply to PIK dividends depend on whether the PIK dividend is paid on common stock or.

Qualified dividends are taxed at. Or qualifying foreign companies whose stock youve held for at least 61 days of a 121-day holding period. If you have qualified dividends and the appropriate paperwork however then your dividend tax is one of three figures 20 15 or nothing at all.

Qualified dividends come from investments in US. Antero Midstreams next quarterly dividend payment of 02250 per share will be made to shareholders on Wednesday November 9 2022. The banks stock is a good choice to consider adding to your TFSA if you are looking.

Capital gains are taxed at a rate of 50 in Canada and the investor must include this in their taxable income. See capital games for details on current past and future tax. The top 20 bracket on.

Visit our Dividend Calendar. If a stock pays dividends you generally must pay taxes on the dividends as you receive them. The taxpayers in the top bracket of 396 used to pay a 20 tax rate on qualified dividend income.

Non-Qualified Dividend Tax Rates for the 2022 Tax Year. Lastly investors that were in the four middle brackets 25 28 33 or. A stock dividend is considered a small stock dividend if the number of shares being issued is less than 25.

The best way to avoid taxes on dividends is to put dividend-earning stocks in a pre-tax retirement account. You generally pay taxes on stock gains in value when you sell the stock.

Double Taxation Of Corporate Income In The United States And The Oecd

Capital Gains Tax In The United States Wikipedia

How Are Dividends Taxed The Motley Fool

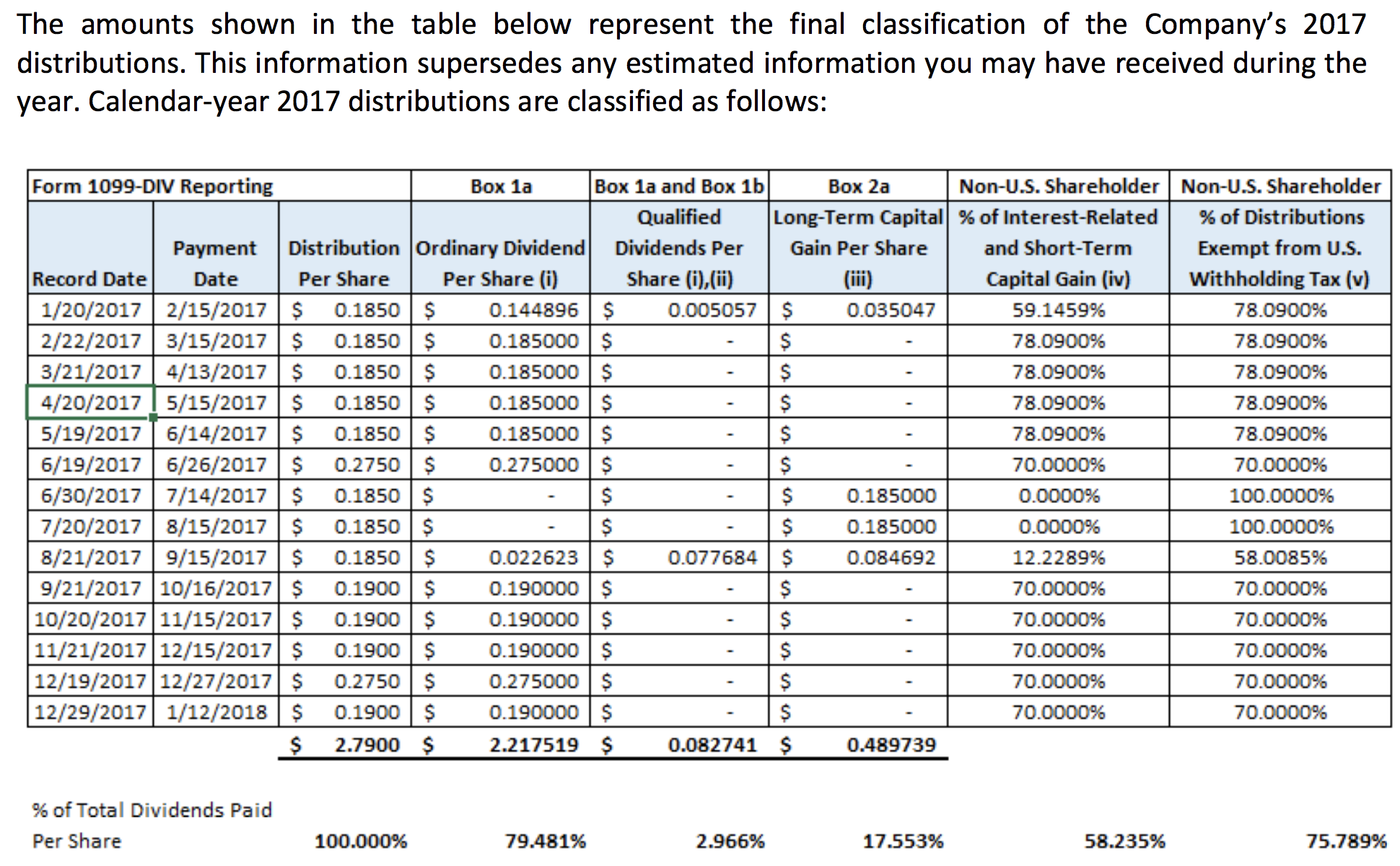

Taxation Of Dividend Income And Capital Gains

How Are Dividends Taxed Overview 2021 Tax Rates Examples

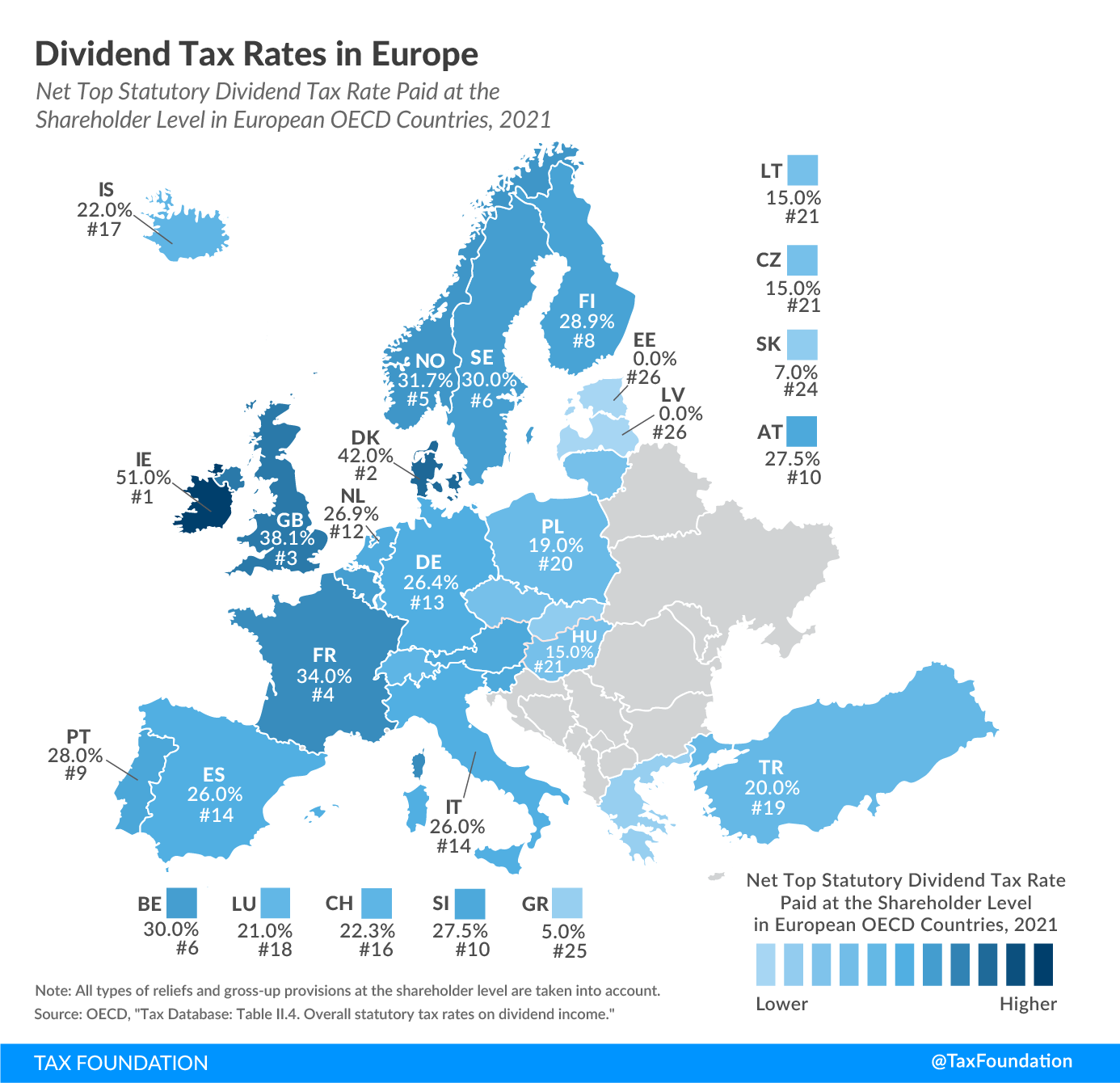

Dividend Tax Rates In Europe 2021 Dividend Tax Rates Rankings

Capital Gains Vs Dividends Top 5 Differences Infographics

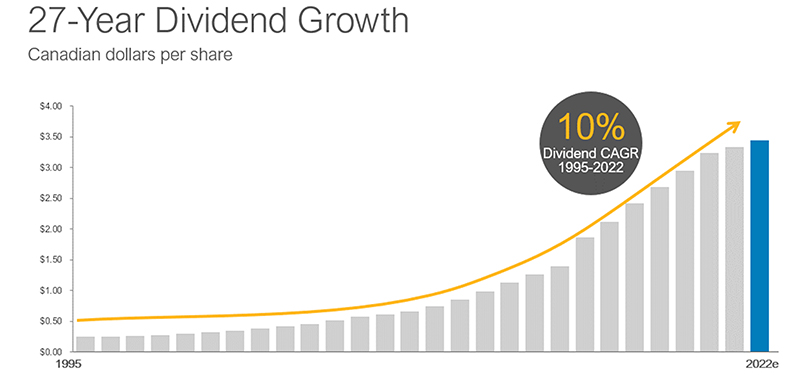

Dividends And Common Shares Enbridge Inc

How Are Stock Dividends Taxed Howstuffworks

Top Dividend Yield Stocks Malaysia To Buy In 2022 Cf Lieu

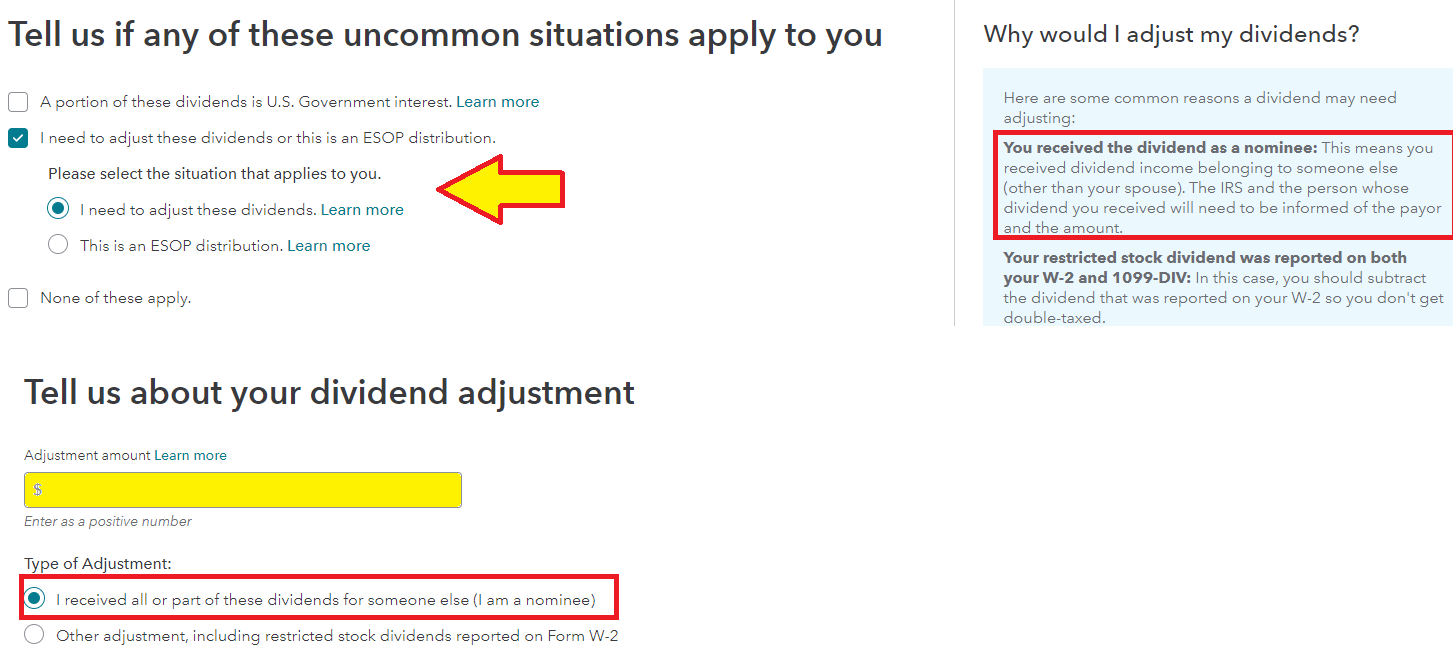

How Do I Report Dividends And Interest On Joint Accounts That All Use His Ssn As The Tax Id If We File Separate Tax Returns

Cost Of Preferred Stock Formula And Calculator Step By Step

Stock Dividends How They Work What They Are Seeking Alpha

What Are Dividends And How Do Stock Dividends Work

Qualified Dividends Definition Explanation Tax Rates

Qualified Dividends What They Are How They Work Seeking Alpha

Dividend Income Taxable From Fy21 How Much Tax Do You Have To Pay Youtube