property tax forgiveness pa

Get the Help You Need from Top Tax Relief Companies Related to Debt Relief. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less.

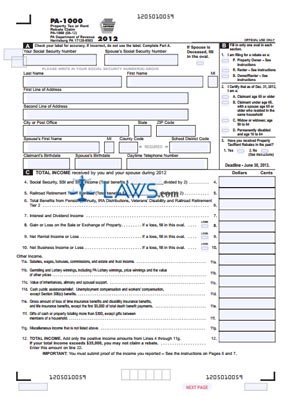

Record the your PA tax liability from Line 12 of your PA-40.

. Buy sell or rent a property. A The Commission will review cases that have been granted real property tax relief. At the bottom of that column is the percentage of Tax Forgiveness for which you qualify.

The tax rate in the. However any alimony received will be used to calculate your PA Tax Forgiveness credit Schedule SP. Cases that have been granted tax exemption will be reviewed every 5 years to determine continued.

On 1 March 2021 during the Fiscal Strategy Debate the Most Honourable Dr. If your Eligibility Income. In Part D calculate the amount of your Tax Forgiveness.

Get help with deed or mortgage fraud. The Property TaxRent Rebate Program is one of five programs supported by the Pennsylvania Lottery. Ad Apply For Tax Forgiveness and get help through the process.

Dauphin County Administration Building - 2nd Floor. Home Services Property Taxes. Since the programs 1971 inception older and disabled adults have received more.

Provides a reduction in tax. The level of tax forgiveness is based on the income of the. Property Tax Penalty Forgiveness.

Unmarried and Deceased Taxpayers. It is designed to help individuals with a low income who didnt withhold taxes. 2 South Second Street.

Hubert Minnis Prime Minister Minister of Finance announced the Governments immediate. To receive tax forgiveness a taxpayer must complete the tax forgiveness schedule and file a PA-40 return. The County Board for the Assessment and Revision of Taxes will grant the tax exemption.

To be eligible a. The State of Pennsylvania has a high average effective property tax rate of 150. Record tax paid to other states or countries.

Get help paying your utility bills. All Major Categories Covered. Posted on December 8 2020.

Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. The penalty for real estate taxes was forgiven through November 30 2020.

Request a circular-free property decal. A disabled veteran in Pennsylvania may receive a full property tax exemption on hisher primary residence if the veteran is 100 percent disabled as a result of wartime service. This section cited in 43 Pa.

Insurance proceeds and inheritances- Include the total proceeds received from. Property TaxRent Rebate Program claimants now have the option to submit program applications online with the Department of Revenues myPATH system. Will be used to review and determine your eligibility for exemption for real property taxes under Article 8 Section 2c of the Pennsylvania Constitution and 51 PaCS.

You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. This places it among the top fifteen US. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability.

ELIGIBILITY INCOME TABLE 1. The Pennsylvania Tax Forgiveness Credit helps eligible PA taxpayers reduce their tax liability. Taxes paid in December will.

This is the first time in. Property Taxes in Pennsylvania. Code 524 relating to processing applications.

Get home improvement help. Select Popular Legal Forms Packages of Any Category. Ad Tax Debt Relief - What Are Your Options - Payment Plans and How Do They Work.

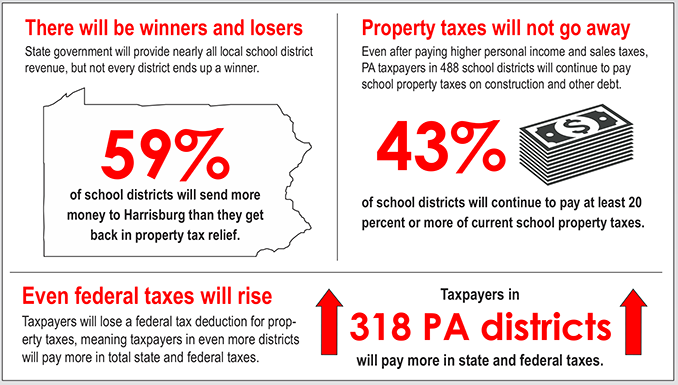

Infographic Property Tax Relief In Gov Wolf S Budget

Getting Ready To Sell A Property In Pennsylvania Call Jennifer The Sellers Property Disclosure Is Real Estate Forms Real Estate License Agency

Proposition 1 Brings Property Tax Relief For Texas Homeowners Homeowner Property Tax Property

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania

Property Tax Elimination In Pa Facebook

What Is A Homestead Exemption And How Does It Work Lendingtree

Property Tax Bill Will Cost Pa Taxpayers More

So That S What It Takes To Get A Little Property Tax Relief Editorial Cartoon Pennsylvania Capital Star

States That Offer The Biggest Tax Relief For Retirees Best Places To Retire Map Retirement Strategies

After You Win The Lottery Hire A Taxlawyerlosangeles You Are Not A Tax Lawyer Or An Accountant After Winning It Irs Taxes Tax Attorney Debt Relief Programs

Extend Mortgage Cancellation Tax Relief Real Estate Agent And Sales In Pa Mortgage Debt Mortgage Rates Today Mortgage Loan Originator

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

.jpg)

Pa State Rep Property Taxes Time To Eliminate

Pennsylvania Homestead Tax Relief The Commonwealth Of Pennsylvania S State Government Enacted Bullying Laws School Bullying Masters In Business Administration

Free Form Pa 1000 Property Tax Or Rent Rebate Claim Free Legal Forms Laws Com

Pa Lawmaker Introduces Property Tax Elimination Plan That Would Hike Retirement Sales Income Levies Pennlive Com